Action

Donations are requested, whether in pre-established amounts (30, 50, 100 Euros) or any other amount, on a monthly, quarterly, or annual basis. The methods for making such donations are indicated on our website www.proyectosamsam.org.

NICOLÁS BARRÉ SOLIDARIDAD is a non-profit organization that operates solidarity projects in Dakar (Senegal) to support the development of its most disadvantaged neighbourhoods and to raise awareness among the Spanish population and the rest of the world. All the funds the organisation raises are exclusively dedicated to SAM SAM PROJECTS.

Our income is derived from internal sources and donations from third parties. The utilization of new technologies for channelling existing aid and donations enables the non-profit organization to seek funding from the public for its projects, despite limited resources and under its specific needs.

The contribution will finance projects in education, health, agriculture, social development, and women’s empowerment, to foster the holistic development of individuals in southern countries, exclusively within our initiatives.

The collaboration shall never be utilized for the purposes of war, partisanship, violence, or aggression against humanity or nature.

Scope of action

NICOLÁS BARRÉ SOLIDARIDAD has the Tax Identification Number R-2000145I. Its social and contact address is calle Ponzano 54, 5º B – 28003 Madrid – Spain – Telephone: 91 441 84 16 and e-mail: p.alfaomega@gmail.com.

By its legal nature, NICOLÁS BARRÉ SOLIDARIDAD is a Non-Profit Entity, under Law 49/2002.

Concerning the solicitation of donations, it is explicitly stated that all actions aimed at obtaining donations adhere to and comply with Spanish legislation in this regard.

Of particular relevance in this regard is the strict adherence to Law 10/2010 on the Prevention of Money Laundering and the Financing of Terrorism.

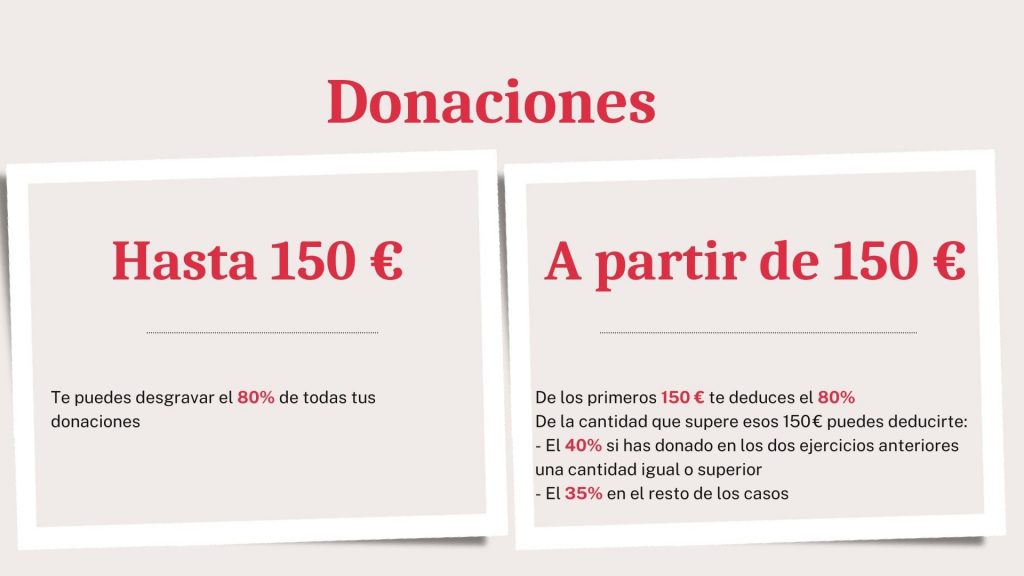

We also explicitly emphasize strict compliance with current tax legislation, which enables donors in Spain to benefit from tax relief in their Income Tax Return when contributing to Solidarity Projects. As of December 19, 2021, the legal regime for the aforementioned tax relief is as follows:

Tax Relief

Deduction and tax relief for donations from individuals resident in Spain to the solidarity projects of NICOLÁS BARRÉ SOLIDARIDAD, as an entity covered by the special tax regime of Law 49/2002, dated 23 December, are as follows:

If you are an individual resident in Spain, you can deduct 80% of the total amount of your donations, up to €150 per year, from your income tax for the current year. Beyond this amount, the deduction will be 35%, or 40% (if you have collaborated with us for at least 3 consecutive years), with a limit of 10% of the taxable base.

If you donate as a legal entity established in Spain, you will be eligible to deduct 35% of your total donations from your corporation tax. In the event of continuous collaboration for at least 3 years, the deduction is increased to 40%, with a maximum limit of 10% of the taxable income.

If you are an individual or legal entity not resident in Spain but earn income in our country, you may also be eligible for a tax benefit based on the amount of your donations. Please refer to the website of the Tax Agency for more information.

If you reside in an autonomous community that is subject to a specific foral regime or has instituted additional deductions for donations to NGOs, the applicable deductions may vary.

Please be reminded that, for us to report the amount of your donations to the Tax Agency, it is essential that you have provided your DNI or NIF along with your address.

For additional information on these tax benefits, you may refer to the website of the Tax Agency’s headquarters.

Confidentiality and Privacy Policy

The personal data requested for the completion of the donation certificate, facilitating tax relief in the donor’s Income Tax Return, shall be governed by the requirements of LOPDGDD Law 3/2018 and the RPGD 2016/679.

For any communication regarding the inherent rights of the donor concerning their data, as well as for reporting any changes to the address, telephone, current account, and email, please contact us at our telephone number 91 441 84 16 or email p.alfaomega@gmail.com. Always mention ‘DONACIONES PROYECTO SAM SAM’ when making the communication.

Delivery of Products, Services and their Guarantees

As this is a non-conditional donation intended for the general purposes of the entity’s Solidarity Projects, donating does not entail the delivery of any product or service, nor is there a right of withdrawal, as established in Law 7/1996, on the Regulation of Retail Trade, and Law 3/2014, of 27 March, which amends the revised text of the General Law for the Defense of Consumers and Users and other complementary laws, approved by Royal Legislative Decree 1/2007, of 16 November.

Acknowledgement

THANK YOU FOR YOUR SUPPORT

With your collaboration, we can contribute to improving the living conditions of many people.